Are you new to the Zyng Corp story? Read our introductory post here

Zyng It On: The ATM's Smart Transition

Zyng Corp is a Calgary based fintech company that aims to disrupt the traditional independent automated teller machine (ATM) industry by evolving ATMs into Smart Kiosks. These Smart Kiosks are essentially multi-functional ATM machines that provide a host of financial services beyond dispensing cash. With a strategic focus on the unbanked/unde…

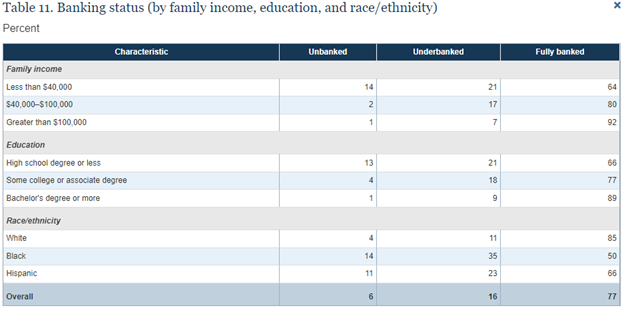

Zyng is zeroing in on a market segment that is often overlooked: the unbanked and underbanked population in the United States. According to the Federal Reserve, an estimated 22% of the U.S. population falls under one of these two categories. To put it into perspective, that's over 72 million people—a market size that is far from negligible.

The Underbanked

The term "underbanked" refers to individuals who have a bank account but also rely on alternative financial services, such as payday loans, check-cashing services, and paycheck advances. As of 2019, about 16% of the U.S. population fell into this category.

The Unbanked

On the other hand, the "unbanked" are those who don't have any form of traditional bank account—checking, savings, or money market. They represent about 6% of the population, which may seem like a small percentage, but when translated into actual numbers, it's millions of people.

Demographics

These statistics are not evenly distributed across all demographics. The issue disproportionately affects low-income and low-education households, as well as minority groups.

The Real Costs

This isn't a mere preference for alternative financial options. In many cases, these individuals have little choice, and they pay the price—literally. Nearly 40% of families with an annual income below $40,000 don't have credit cards. This not only leaves them vulnerable to high-interest loans but also deprives them of the opportunity to build a credit history, which could lead to more financially favorable options in the future.

Market Opportunity for Zyng

For Zyng, the sheer size of this underbanked and unbanked market presents a golden opportunity. If the company can offer financially inclusive products and services, it stands to not only achieve business success but also to make a meaningful impact on the lives of millions.

In addition to that the Zyng pre paid cards offer business an alternative to inhouse gift cards while still reducing the need for accepting cash. The advantages of this is customers cash is not tied to one business while the businesses remove the need for cash therefore removing the potential for theft. We have seen this in several business in the US where they have opted to refuse cash payments but have installed a kiosk where customers will be able to purchase a pre paid card that isn’t limited to just that establishment.