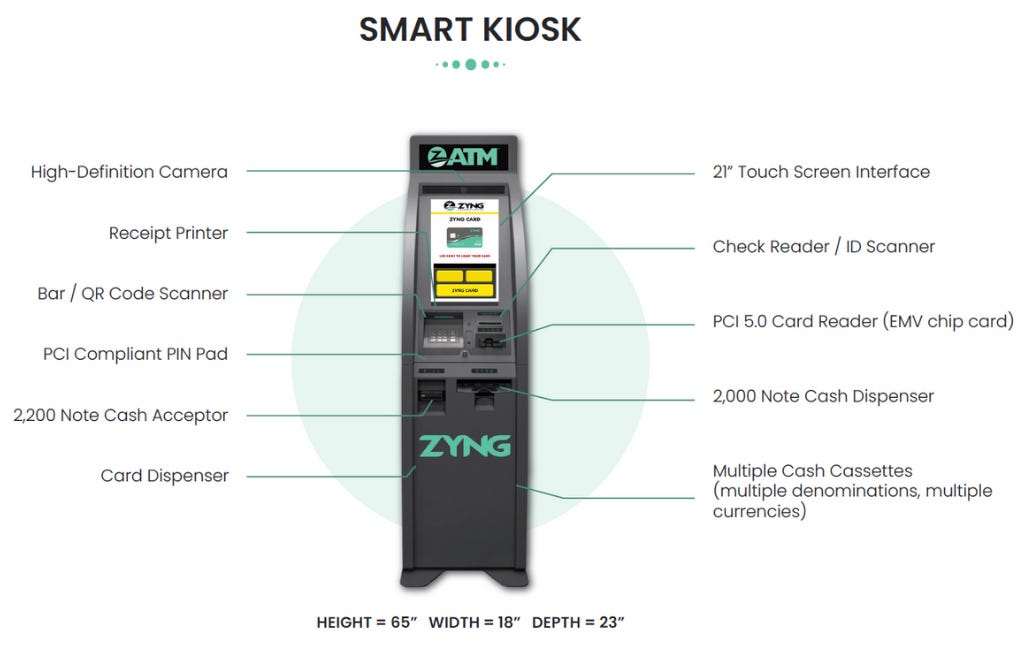

Zyng Corp is a disruptive Calgary based fintech company that aims to disrupt the traditional independent automated teller machine (ATM) industry by evolving ATMs into Smart Kiosks. These Smart Kiosks are essentially multi-functional ATM machines that provide a host of financial services beyond dispensing cash. With a strategic focus on the unbanked/underbanked populations, Zyng leverages its proprietary fintech software to unlock new consumer services and generate additional revenue streams for their ecosystem.

Advantages of Smart Kiosks Vs Traditional ATMs

Zyng’s Smart Kiosks offer a multitude of advantages over traditional ATMs. While ATMs are generally limited to dispensing cash, Smart Kiosks provide a variety of additional financial services. These include;

Accepting deposits

Money transfers

Bill payments

Cash advances/Micro-lending

Bitcoin transactions

Pre-paid debit cards

These services cater to the needs of a wider customer base, particularly those who are unbanked or underbanked. The deployment of Smart Kiosks helps consumers transition from cash to digital, providing the benefits of digital banking to people who otherwise might not have access to it.

Current Kiosks and Growth

Zyng Corp began its operations in Arizona and Nevada, with its first significant acquisition of a 60-kiosk route in April 2021. This marked their initial 12 months of operation, during which they managed to generate revenues from these kiosks. The subsequent year, 2022, saw a major expansion with the acquisition of a 145-location company in January, expanding their operations into California. Zyng currently has 374 ATMs and 14 Kiosks with a target of 500 and 50 by the end of the year. While the number of kiosks is currently dwarfed by the ATM business the plan is to see this ratio flip by the end of 2024.

Existing & Target Markets

Zyng Corp currently operates in Arizona, Nevada, Texas, Georgia, New Mexico, and California. Expansion into additional states will focus on locations with the largest percentage of underbanked and unbanked as seen in the image below.

So who are the unbanked and underbanked? Unbanked individuals do not have a checking or savings account while underbanked individuals have a bank account but still use financial services outside the banking system, like payday loans, check-cashing services, and money orders. Being unbanked and underbanked has several disadvantages such as:

Higher Costs: Financial products and services outside the traditional banking system, such as payday loans or check-cashing services, can be very expensive. Check-cashing services can charge fees of up to 3% while payday loans have extremely high rates topping out at a 400% APR

Limited Access to Credit: Without a history of traditional bank accounts and credit products, it can be harder to get a credit card or a loan, which are often necessary for large purchases like cars or homes.

Insecurity: Keeping cash at home can be risky because it's susceptible to theft or loss.

Inconvenience: Without a bank account, tasks like receiving a paycheck, paying bills, or making purchases online can be more challenging and time-consuming.

Lack of Savings and Investment Opportunities: Traditional bank accounts often come with the option to earn interest, and banks can provide access to various investment products. Those outside the banking system miss out on these opportunities.

No Protection: Bank accounts in the U.S. are insured by the FDIC up to $250,000. This means if the bank fails, the customer's money is still protected. This is not the case with money kept outside the banking system.

Growth Strategy

Zyng Corp's growth strategy is multi-pronged. The first aspect is the expansion of its existing product and service offerings into new markets which could include acquisitions and strategic investments. Additionally, Zyng Corp plans to capitalize on its proprietary fintech software by licensing it to third-party operators and independent ATM deployers (IADs), thereby generating recurring revenue in a Software-as-a-Service (SaaS) model. Furthermore, Zyng is introducing a pre-paid card that leverages their physical network to tap into the Neobanking market.

Competitive Landscape

Zyng Corp operates in a highly competitive fintech space, which is continuously evolving with technological advances and changing consumer demands. While traditional banks and ATM operators are their immediate competitors, other fintech companies looking to disrupt the banking and financial services industry also pose a significant challenge. However, Zyng's competitive advantage lies in its proprietary fintech software and innovative Smart Kiosks, which provide an array of financial services beyond what traditional ATMs offer. There are also some significant barriers for new entrants into the market including;

Smart Kiosks require significant/sophisticated software development (Zyng has 20-plus years of development on current Kiosk Engine)

MSB (Money Services Business) requirements

Local banking relationships for loading cash and cash deposits

State and Federal licensing obligations

Compliance and licensing for operators

The current competitors in the space can be broken down into two groups:

Kiosks —Maya Tech, Prepaid Kiosk (these companies have Cash In ONLY kiosks)

Cards —Chime, Ally, SoFi (these companies are not able to load cards at a kiosk)

Summary

Zyng is on a strategic path to disrupt the independent ATM provider business model with its Kiosks and pre-paid card business by focusing on the underbanked and unbanked, a traditionally underserviced demographic. They do this by providing an interface for users through their proprietary software on the front end that is backed by Sigue, who provide all of the KYC/Anti-Money Laundering compliance checks, eliminating the risk exposure for Zyng.

This is our first post in a series that will dive into Zyng, the company, the market and the opportunity they have.