Recession! Recession?

The war between Russia and Ukraine, rising trade tensions between the east and west, rampant inflation, and the wrecking ball of the US dollar are all front and centre in investors' minds. Are we in a recession or heading for one, and what to look out for over the next 12 months?

A recession is generally defined as two consecutive quarters of declining gross domestic product (GDP). Economic output, consumer demand, and employment typically fall during recessions.

The United States economy shrank at an annual rate of 0.6% in the second quarter, marking the second consecutive quarter of negative GDP growth and signalling the economy has entered a technical recession, according to the Bureau of Economic Analysis's final estimate released last month. Surprisingly the U.S. economy posted its first period of positive growth for 2022 in the third quarter (+2.6% annualized), temporarily easing recession fears.

Aside from this semantic argument, the reality is apparent: the US economy is weakening and, if not already in recession, is likely to enter one soon. The culprit is rapidly declining global liquidity conditions exacerbated by central banks, most notably by the Fed in the United States, rapidly increasing interest rates to combat high and persistent inflation.

Inflation

In early 2021, a global increase in inflation began. It has been blamed on various factors, including pandemic-related fiscal and monetary stimulus, supply chain disruptions, price gouging, and, as of early 2022, the Russian invasion of Ukraine. While the Fed referred to the increase as transitory, it has turned out to be anything but.

While the current inflation rate in the United States has slowed for the third straight month coming in at 8.2% in September, which is the lowest in 7 months, it was still above forecasts of 8.1%.

Meanwhile, the core rate, which excludes volatile food and energy, rose to 6.6%, the highest since August of 1982, and above market expectations of 6.5%; inflationary pressures remain elevated even as energy prices declined, along with a slight slowdown in food inflation and used vehicle costs helping to ease price pressures. On the other hand, prices for shelter increased faster than expectations and will likely remain sticky for some time due to the lagging nature of the measurement. Meanwhile, the core rate, which excludes volatile food and energy, rose to 6.6%, the highest since August of 1982, and above market expectations of 6.5% is a sign inflationary pressures remain elevated and well above the Fed's target rate of 2%.

The CRB index shows that Commodities increased rapidly after the pandemic-induced recession but have since pulled back. The decline in commodities prices and a collapse in shipping rates have helped offset some of the inflationary pressures. Time will tell if prices continue to moderate, but the ongoing war in Ukraine and years of underinvestment will likely keep some upward pressure on the energy complex.

At its core, the Federal Reserve has two main jobs: keeping inflation low and ensuring the maximum number of people are employed in America. This is known as the Fed's "dual mandate.

The US economy has shown remarkable resiliency despite the rapid interest rate rise. As of the September report, the unemployment rate is still a surprisingly low 3.5%. On the other hand, U.S. job openings fell by the most in nearly 2-1/2 years in August, suggesting that the labour market was starting to cool as the economy deals with higher interest rates aimed at dampening end market demand and taming inflation.

That said, the Fed appears focused on another of their favourite indicators, highlighting the strength in near-term inflation pressures. The Employment Cost Index showed that labour market inflation pressures remain strong, rising 1.2% quarter-on-quarter in the third quarter after a 1.3% increase in the second quarter. This is double the 0.6% QoQ average over the past 15 years, indicating that this will still be an issue for the Fed given its increased prominence in how the central bank assesses the risks.

The U.S. dollar

Rapidly rising interest rates to combat inflation and a resilient economy have strengthened the USD sharply against almost every other currency. The dollar appreciation is a significant challenge for most countries, especially in emerging markets, as seen by the default of Sri Lanka in the spring of 2022.

The dollar's strength can be traced to the relative attractiveness of United States assets. The Federal Reserve has been raising interest rates more aggressively than other advanced economy central banks, including the European Central Bank, the Bank of England, and the Bank of Japan. Growth in the United States, which showed weakness earlier in the year, is significantly better than in many other countries.

The strong dollar can cause many problems for emerging economies as most of their receipts are in local currencies, but their debts are often in US dollars. The negative impacts of a strong dollar on emerging economies are heightened because many of these countries increased their debt levels due to the pandemic. This could lead us to more situations like the Sri Lanka default and continue to hamper the emerging market growth.

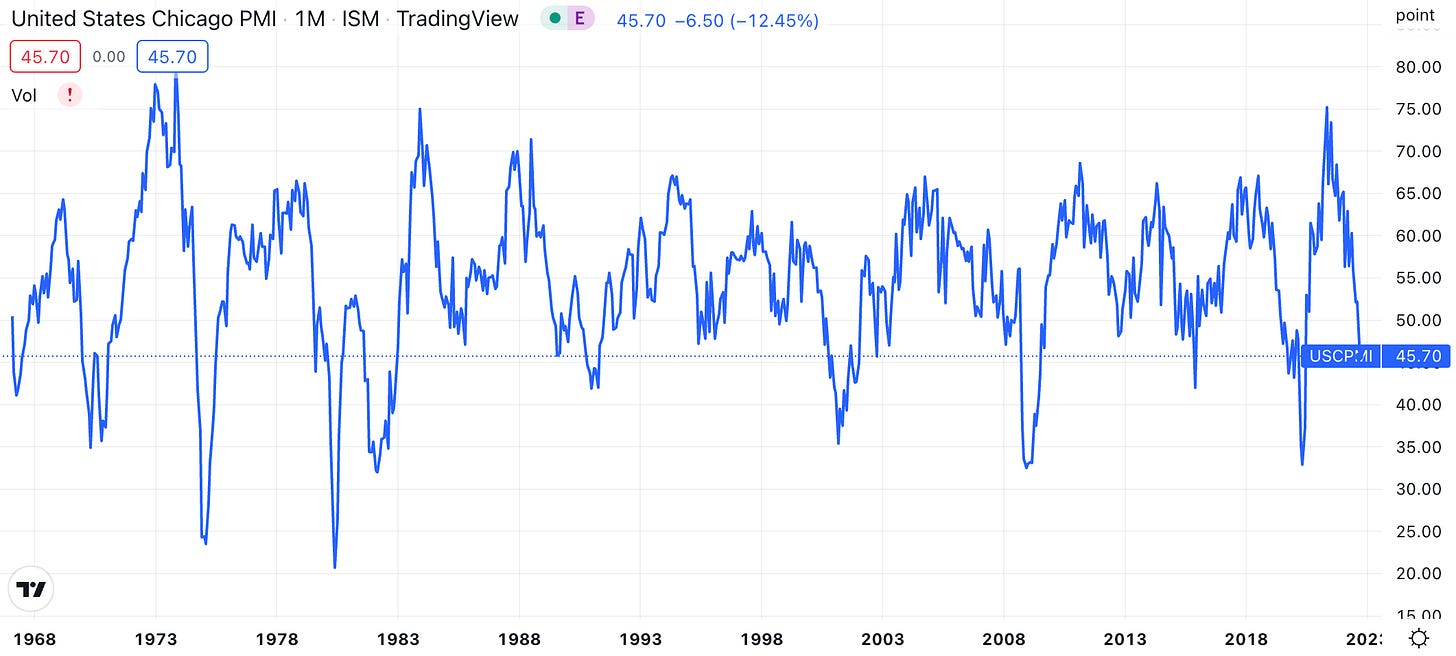

Looking forward, if the Fed continues to raise rates faster and higher than current market expectations, they risk the likelihood of causing something to break in the global financial system in their effort to reign in inflation. Forward-looking economic indicators, such as the Purchasing Managers Index, point to economic weakness and slower inflation in the coming quarters.

Housing

The rapid rise in mortgage rates has also caused a noticeable weakness in the housing market. The NAHB housing market index in the US fell for the 10th straight month to 38 in October of 2022, half the level it was just six months ago and below market expectations. This was the lowest reading since August 2012 due to rising mortgage rates, which have more than doubled from their low, and elevated home prices.

If we look towards the equity markets, earnings miss by Alphabet, Microsoft, Amazon, and Meta point to weakening demand in the once-hot technology sector while the strong dollar hurts their overseas profits; this will likely lead to layoffs in the tech sector which might help ease some of the pressure in the labour market. This might give the Fed a reason to slow down the interest rate increases and perhaps pause them in Q1 2023, taking some pressure off the global currency and bond markets.

Looking Ahead

The Fed has been laser-focused on putting the inflation genie back in the bottle after finally admitting that the rising inflation rate was not “transitory.” This leads to the genuine risk of the Fed aggressively tightening into a weakening economy and risking a severe recession.

Our base case is for inflation to continue to decline in 2023 with a weakening economy and a likely recession. It seems reasonable to believe the Fed can get inflation down to the 3-4% range, but getting lower may pose a significant challenge (especially as 2024 is an election year). This could lead to the Fed floating the idea of setting their inflation target at a higher level over the next 12-24 months. Such a move's implications are significant and worth keeping in mind as investors try to navigate a challenging macro environment. We expect the Fed to increase the Fed funds target rate by75bps in November. December could be the first month of the Fed slowing rate hikes, with the odds almost equal for a 50bps or 75bps increase. The Fed pivot is coming closer, but it will need significantly softening numbers in the labour market and inflation to change the Fed's trajectory. Overall, liquidity conditions remain tight, the economy is weakening, and geopolitical risks remain very high.

Opportunities will come. Be safe out there.

.

What is the administration going to do this winter when there is limited and expensive home heating oil and gas due to limiting America's production, limited and increasingly expensive food supplies due to Russian grain export blockage, increasingly expensive rentals, decreasing home sales due to high mortgage rates and increased crime? Walking away from questions at a rare news conference or crackling while giving an unrelated answer is the usual answer.