EXRO Technologies: Customer and Revenue Growth Outlook

Edging Towards Commercial Revenue

New to the Exro story? Read our Intro post here:

Moving from idea to revenue

As an early-stage, pre-revenue tech company, Exro’s ongoing challenge navigate both securing potential customers, while concurrently raising capital to fund its strategy and providing visibility to timing of revenue. Exro is currently constructing a world-class fabrication facility in Calgary, Alberta, which is expected to be complete in Q3 2023. Once completed, the facility will have the capability to produce 100,000 Coil Driver units per year, per 8-hour shift. Under the assumption the fabrication ultimately moves to 24-hr operation, this implies upside capacity of 300,000 units per year.

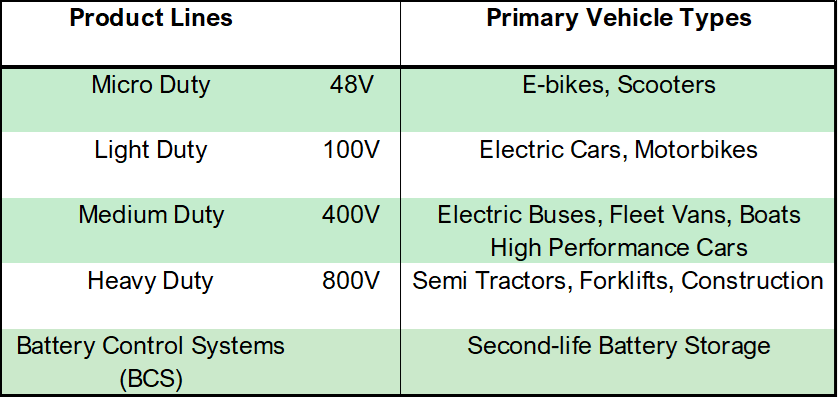

Exro provides its Coil Driver over a wide range of voltages, applicable in different operating conditions. A quick summary is presented below. At the lower voltage end of the spectrum, Coil Drivers can be applied to micro-transport vehicles such as E-bikes and scooters, while higher voltage Coil Drivers have potential use in Semi Tractors and other heavy duty equipment.

Exro also has a Battery Control System product line. We will save a deep analysis for a future post, but we find this to be a cool technology in its own right. Essentially Exro’s BCS technology can take used batteries and extend their life in energy storage applications.

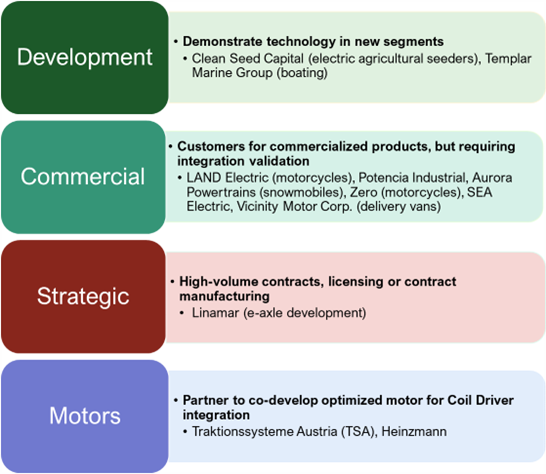

To facilitate the penetration, product development and validation of its Coil Driver product line, Exro is actively engaged with a number of potential partners. These partnership models can be grouped into four types, as shown below, along with the companies Exro is in discussions with currently. Development Partners aim to demonstrate Exro’s technology in new applications. Strategic Partners have the potential to result in high-volume contracts. Exro is actively working with Linamar, a Tier-1 supplier to vehicle OEM’s (Original Equipment Manufacturers). Linamar and Exro are developing an integrated E-axle, where Exro’s Coil Driver and other associated equipment (motor, gearbox) are integrated into one unit. Motor Partnerships aim to develop motors optimized for Coil Driver integration.

In this post, we want to focus on Exro’s Commercial partners, as they are the most relevant to the near-term revenue growth potential for the company. To remind readers, Exro has announced the following initial agreements over recent months:

Exro will supply up to 2,500 high-voltage Coil Drive systems to Vicinity Motor Corp for use in the company’s electric buses. This agreement has an initial purchase order of 100 units and commenced with a pilot beginning in 2Q22.

Exro will supply an initial 1,000 units of its 100V Coil Drive system to evTS (ev Transportation Systems), a Boston-based EV manufacturer for use in its FireFly vehicles. The agreement commences in 2023.

Exro will supply SEA Electric with high voltage Coil Drive Systems for use in SEA’s delivery vehicles. Exro will deliver up to 25 sample units as early as November 2022, which will be tested in-field for up to 9-12 months. Following this, Exro will deliver an initial purchase order of 500 units with a minimum 1,000 additional units over the 36-month term.

Putting some revenue estimates to the orders

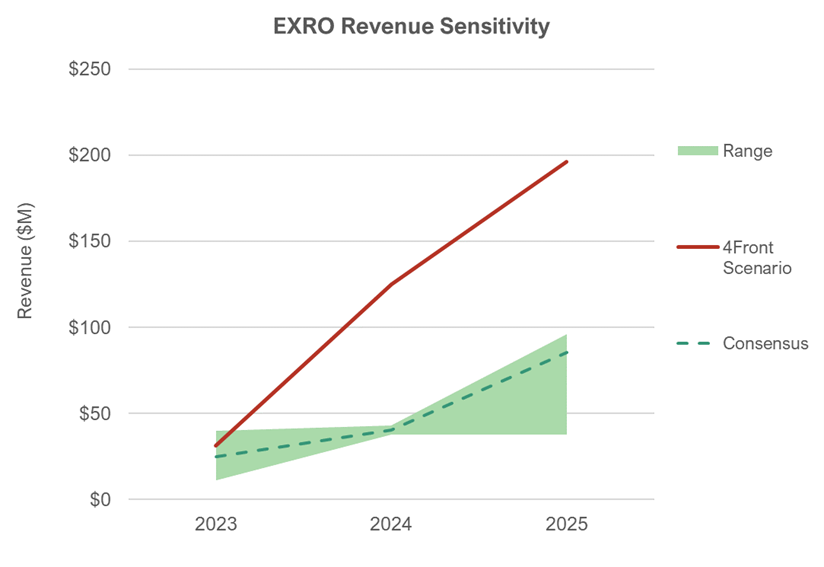

Based on the initial order flow listed above, and after some discussions with Exro management, we prepared a rough revenue model by quarter, through the end of 2025, as show below. Of note, the blue values are an estimate of the order growth that the company has disclosed to date. The green values are our (4Front Advisory) scenario estimates to show the impact of a few more agreements in the future. Unit prices for the Coil Drivers have not been disclosed, estimated using industry contacts and pricing guides for typical inverters.

A few assumptions are worth noting:

The purchase orders to date are in the 100V and 400V range for Vicinity, evTS and SEA Electric. Thus, these product lines will be further along the validation stage as Coil Driver units are delivered.

We have assumed evTS follows its initial 100V order with an order 1.5x 2023 levels starting in 2024. We have also assumed further initial orders materialize with delivery in the 2024 time-frame of a similar size the evTS initial agreement.

For the 400V units, we have made a similar assumption at Vicinity and SEA also increase their order by 1.5x once the initial agreement is complete. We have also presented another line of growth similar in size to the agreements signed by Vicinity and SEA starting in late 2023.

For the 800V line, we assumed an agreement materializes over the next year with delivery in mid-2024. Exro has not provided any guidance to cost for these units, so our estimate of US$25K each is purely an estimate.

The takeaways we see are the following:

Exro is well positioned to deliver significant revenue growth, even just on orders it has secured to date

Our estimates for future purchase orders over coming quarters, which we think is achievable, provides visibility through 2025

Notably, even with our forecast growth, this only implies 10% utilization of the company’s fabrication facility by year-end 2025.

We have not layered in any revenue potential for the BCS technology or other revenue at this time.

We expect further announcements on partnerships, purchase order agreements, results from field validation tests, will provide ongoing catalyst support for the company over coming quarters.

Comparing to Market Expectations

Exro currently has four research analysts covering the stock. We pulled consensus cash flow over the next few years to compare with expectations. Our initial rough model suggests there could be substantially higher revenue growth than what is currently being expected. We expect consensus numbers do not factor in any potential for further purchase order agreements. Thus, should Exro secure further orders for its Coil Drivers, we see positive revenue revisions as another catalyst for investors.

Risks to the outlook

Timing of revenue and purchase orders remains an ongoing risk; however, we are encouraged by Exro’s relationships with potential partners and progress to date.

Exro is in the midst of a capital raise and has recently closed a brokered public offering of 7.92M shares at a price of $1.05 for gross proceeds of $8.3M. The company is concurrently pursuing a non-brokered private placement of up to an additional 2.86M shares (~$3.0M) expected to close mid-September 2022. Both offerings include a full warrant with a 48-month term with an exercise price of $1.36/sh. We view the closing of these offerings as a positive step to providing visibility to the revenue growth later in 2023.

Exro’s technology needs to be independently verified and tested by partners to meet their strict specifications. This is a time-consuming process and timing of larger-scale orders is contingent on these hurdles being met first. We see this as potentially being one of the more frustrating items for potential investors, who may not appreciate the time required for Exro and partners to de-risk the Coil Driver in field applications.

Quick question. What incremental Rev is included beyond the the forecasted coil drivers? Based on the unit forecast and price/unit there is an ~$7MM gap (2023). Is this Services revenue out of the Detroit facility, BCS, or a combination and just not disclosed on the table in your post above? TIA and its great to have some local representation for EXRO, looking forward to seeing more great work out of the 4Thoughts team.

To refresh our memories, which were the 'original seven pilot programs'? Thanks!