Chances are if you look down at your laptop there is a small sticker with either an AMD (NASDAQ:AMD) or Intel (NASDAQ:INTC) logo. In fact, Intel alone accounts for 75% of all laptop CPUs as of early 2024. But its NVIDIA (NASDAQ:NVDA) is now up close to 700% from its lows in 2022, far outpacing the other chips. So why is NVIDIA the one pushing the NASDAQ to new all-time highs?

The answer is in the type of chip Nvidia makes, the discrete graphic processing unit or dGPU sometime referred to as an add in board or AIB.

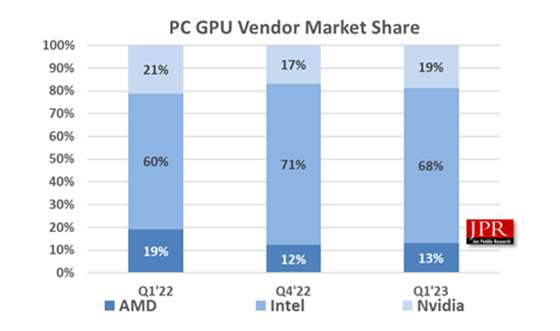

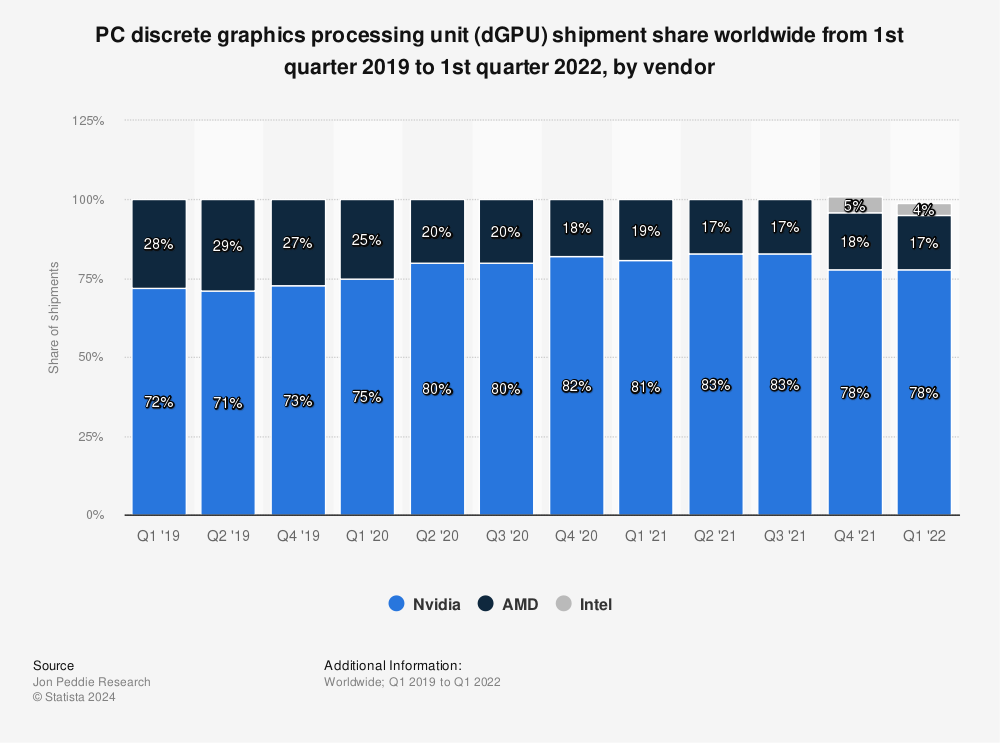

As you can see in the charts below while Intel is still the biggest player for all GPUs Nvidia still controls the lion’s share of the dGPU’s although AMD has been slowly increasing their market share.

https://www.jonpeddie.com/news/pc-gpu-shipments-decreased-by-14-0-sequentially-from-last-quarter-and-decreased-an-astounding-43-year-to-year/

While Intel still dominates the CPU and integrated GPU (iGPU) market, the growth in demand for dGPU’s has increased in recent years on the back of relatively new industries like crypto mining, autonomous vehicles and AI (Artificial Intelligence), all of which require the horsepower provided by a dGPU. So, what is the difference between the two?

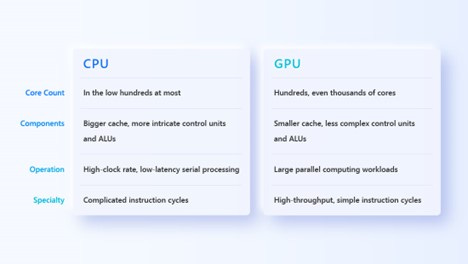

GPU vs CPU

CPUs: The Brain of the Computer

A CPU exists to execute very quick calculations, handling a large variety of tasks, and managing data flow within the computer. It is built to be a jack-of-all-trades, but it handles tasks sequentially or in small groups, which is efficient for general computing tasks such as browsing the web, doing homework, or running software.

GPUs: The Team of Specialists

The GPU shines when it comes to handling visuals, such as rendering video games, creating 3D animations or processing vast amounts of image or video data. GPUs can process multiple concurrent tasks, rather than just sequentially. This is called parallel processing, and it is what makes GPUs ideal for AI and Crypto Mining, among other things.

Rising demand for the high end dGPU’s like Nvidia’s H100 has seen chip prices increase to north of US$40K meaning a supercomputer like the one Google built last year can cost upwards of US$1B in GPU costs alone.

The rise of GPUs to the cloud

While the processing power of these GPUs are used constantly in applications such as crypto mining, the need for massive on demand computing power has resulted the rise of GPU clouds. Tech giants such as AWS, Microsoft and Google all active in the market as well as some smaller private companies such as:

As for publicly traded GPU cloud companies Hive Technologies (TSX:HIVE, NASDAQ:HIVE) offers cloud-based GPUs (hivecloud.com) as well as mining proof-of-work digital assets.

Takeaways

While Nvidia has a healthy lead on its competitors we have seen AMD chip away at their market share over the past few quarters. However if we take a look at historical performance they have yet to regain the penetration rate of 2019.

Despite that the global GPU market is expected by some to grow from $42B in 2022 to $770B in 2032 , representing a CAGR of 33.8%, meaning there is room for both of these players to see strong growth in their GPU sales.