New to the Exro story? Read our Intro post here:

Ticking the boxes in 2022

The broader market was volatile in 2022 to put it mildly. Overall tech valuations imploded as investors finally seemed to catch on that the business fundamentals for many did not warrant the lofty valuations being ascribed by the market. Against that backdrop, Exro made several positive steps towards achieving first (meaningful) revenue in 2023. Here are of a few accomplishments that we think are most relevant:

Feb 4: Company closes equity financing of $20.35M at $1.60/sh. Investors on the deal receive on common share and a half warrant exercisable at $2.00/sh for 36 months.

Feb 17: Darrell Bishop joins the company as Present, Finance and Investor Relations. Readers may know Darrell from his time as Managing Director of Investment Banking at Haywood Securities, with stints in equity research and technical roles as an engineer prior to that. We see this as a positive step for the company in its ability to access capital and expand its message to a new investor base.

Mar 23: Rob Copes joins Advisory Board, formerly COO at Rivian. We see Mr. Copes bringing insight into the inner workings and strategy of EV companies. Mr. Copes ultimately moved to a full Board position in May.

Apr 22: Exro’s Coil Driver wins Gold Edison Award for Best New Product in manufacturing.

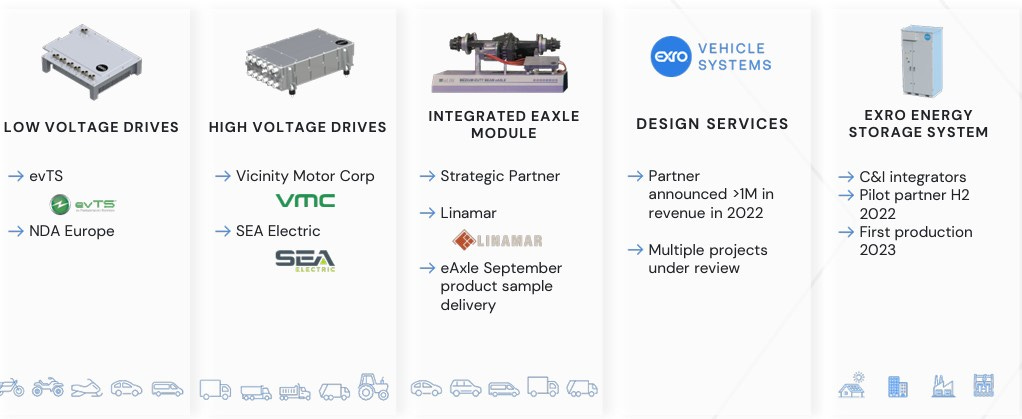

May 3: Company signs multi-year agreement with Vicinity Motor Corp to supply high-voltage Coil Drivers for use in its bus fleet.

May 11: Exro signs multi-year purchase order agreement with evTS to supply a first lot of 1,000 Coil Drive systems starting in 2023.

Aug 16: Exro signs multi-year agreement with development partner Sea Electric to supply high-voltage Coil Drive systems for the company’s next-generation commercial vehicles.

Sep 1: Exro closed a brokered public offering for gross proceeds of $8.3M at a price of $1.05/sh. Investors received one common share and one full warrant exercisable at $1.36/sh for a period of 48 months.

Sep 20: Exro closed a non-brokered private placement, also comprised of one common share at $1.05/sh and one full common warrant with an exercise price of $1.36/sh with a 48-month term.

Sep 27: Exro announces its Cell Driver passed the first phases of UL certification. In simplest terms, the testers tried to make Exro’s Cell Driver fail through a thermal runaway (fire), but could not force this to happen. This provides great visibility for the Cell Driver’s cell level control to provide enhanced safety performance versus peers.

Sep 28: Company signs a strategic agreement with Inferno Solar in Alberta for the distribution of its Cell Driver within Western Canada.

Oct 5: Product development agreement signed with European partner for application in hybrid diesel-electric off-road vehicles. Initial Exro Coil Driver sample units to be delivered in 1Q2023, transition to 8-10,000 units per year upon successful customer testing and validation.

Oct 13: Exro’s Coil Driver technology wins 2022 Engine Tech Innovation of the Year at AutoTech’s 2022 Breakthrough awards. Another independent verification of Exro’s value proposition.

Nov 15: The company resolved a dispute with ePropelled Inc., with the parties agreeing that the Coil Drive system does not infringe on any claim of ePropelled’s patent. We see this as a key overhang removed for Exro shareholders, clearing the way for visibility to revenue generation in 2H23.

Nov 18: Company is recipient of 2022 Illuminations Award for Business Innovation, determined by the National Electrical Manufacturer’s Association.

Nov 30: Exro announces it has successfully completed Phase 1 of its integrated e-axle co-development program with Linamar Corporation. This is a key hurdle providing visibility with commercial development with a Tier 1 EV manufacturer.

Dec 7: Announces a $15M convertible debenture offering. The debentures pay 12% per year in in interest and are convertible to equity at an exercise price of $2.40/sh and have a maturity date on Dec 31, 2027.

Overall, Exro advanced initiates on all of its product offerings over 2022, and we expect this momentum to be carried into 2023

Share Price Rebounding

2022 was a lackluster start for EXRO with the stock dropping over 60% in the first two months of the year. This far outpaced the broader tech market which saw a drop of roughly 20% over the same period. When we look at the timeline highlighted in the year in review we see that a turnaround for Exro started in February with the capital raise of $20M. Over subsequent months, new management additions and movement on the order front provided ongoing catalysts. Since then EXRO has risen 25% while the sell-off in tech markets have continued, dropping 25% over the same period.

The turnaround was supported by a number of positive news releases noted earlier that continued to de-risk the story and remove some of the negative overhang. This, in turn, has improved the technical outlook for stock performance, first with a sustained break above the $1.00 level of resistance and then with another break through $1.65.

In the short term you could see EXRO trade back down to the $1.65 level but momentum has clearly shifted as can been see in the MACD and, despite a recent pullback, with more positive news anticipated we expect this momentum to continue into the new year.

2023 Catalysts

Looking into next year, Exro is on the cusp of crossing the tech chasm from being pre-revenue with limited near-term sales visibility, to commercial scale production backed by tangible customer orders. We believe many institutional investors tend to sit on the sidelines until key hurdles such as customer visibility, financing and time to cash flow are reduced in terms of risk. We see 2023 as being catalyst-rich for Exro, with the following items something investors should monitor:

Fabrication facility completion. Exro expects its ISO-9001 certified fabrication facility in Calgary, Alberta Canada to be operational by 3Q23. As a reminder, the capacity for the facility is 100,000 coil driver units per 8-hr shift, thus expandable to 300,000 units assuming continuous production over time.

Strategic Funding / Partner. With ongoing independent and development partner testing and certification for Exro’s Coil Driver, acceptance on this front could see demand for Exro’s products ramp-up exponentially. To help fund that future potential growth, Exro is currently evaluating strategic funding or partnership. We see this as a key hurdle that, once cleared, further provides multi-year visibility for growth, and de-risks further financing requirements.

Customer Orders. For both the Coil Driver and Cell Driver, we see ongoing purchase orders by top-tier electric vehicle manufacturers as data points over 2023.

Testing / Validation / Certification. We feel this process is not well understood by investors. Given Exro’s Coil Driver is to be used in personal automotive applications, the testing and safety requirements are rigorous and time intensive. Certification approval increases the potential for further order flow, in our opinion, plus further de-risks the story for institutional investors that may be sidelined pending news on this front.

Disclosures

4Front is compensated by Exro for the preparation of these materials. 4Front receives its compensation in cash. 4Front participated in Exro’s recent equity raise and is currently a shareholder of the company.

4Front publishes 4Thoughts for the purpose of investor education. All statements presented herein are the sole opinion of 4Front Advisory and/or the individual author. The intent of 4Thoughts is to provide insight and analysis into our clients’ businesses, strategies, opportunities, and risks.

4Front Advisory is not an investment advisor, and comments and opinions presented in 4Thoughts should not be interpreted as investment advice. Investors should pursue their own due diligence regarding the merits if any potential investment decisions for companies discussed herein. Investors should seek advice from professional financial advisors before making any investment decisions. 4Front Advisory does not express any opinion with regards to the price of securities of any company may trade at any given time.

Forward estimates, macroeconomic commentary and forward-looking statements are based on assumptions and individual analysis and interpretation and thus are inherently unreliable. Commentary is based of information available as of the time of writing, and other events and externalities may subsequently occur that materially change the interpretation presented.

4Front Advisory does not accept any liability for any direct or indirect loss arising from commentary and opinions provided herein.

This article, and any item we publish or on behalf of our clients and should not be construed as an offer or solicitation to buy or sell products or securities.

Occasionally, reference may be made in our published materials (online commentary, website, presentations) prior articles and opinions we have published. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. Readers acknowledge previously published information and data may not be current and should not be relied upon.