Exro Technologies (EXRO.TO) Sea Electric Merger Accelerates Coil Driver Deployment with Tier 1 Suppliers

Accelerating visibility to revenue and EBITDA growth

Key Takeaways:

Exro recently closed a bought deal private placement offering of 31.6M subscription receipts at C$0.95 for gross proceeds of ~C$30M.

Exro’s initial push will be with Light Duty Vehicles, not EV Passenger Vehicles, which should accelerate deployment of Coil Drivers into the market.

Exro’s merger with Sea Electric allows the company to transition from a supplier of a single component (specifically the Coil Driver) to a Tier 1 supplier to OEMs.

In our previous post, we provided some initial commentary on Exro’s proposed merger with SEA Electric. In this post, we delve more into the opportunity with SEA Electric.

SEA Electric provides Coil Driver implementation in Growing Commercial Vehicle Market

Earlier this week, we put out a note highlighting how we feel Exro’s share price is being dragged down by particularly negative sentiment on Passenger EV’s (Link ). A number of EV manufacturers have pushed out their timelines to reach 100% EV sales, while demand for some car/truck models has been weaker than anticipated.

Granted, some of Exro’s strategic partnerships, such as the one with Linimar, will be more focused on the passenger car market. However, other partnerships, such as the one with Giaffone in Brazil, are targeting the light commercial vehicle (LCV) market. The merger with SEA Electric will accelerate deployment of Coil Drivers into the LCV market on an integrated basis with SEA’s existing product line.

LCV Sales Catching up with Passenger Vehicles

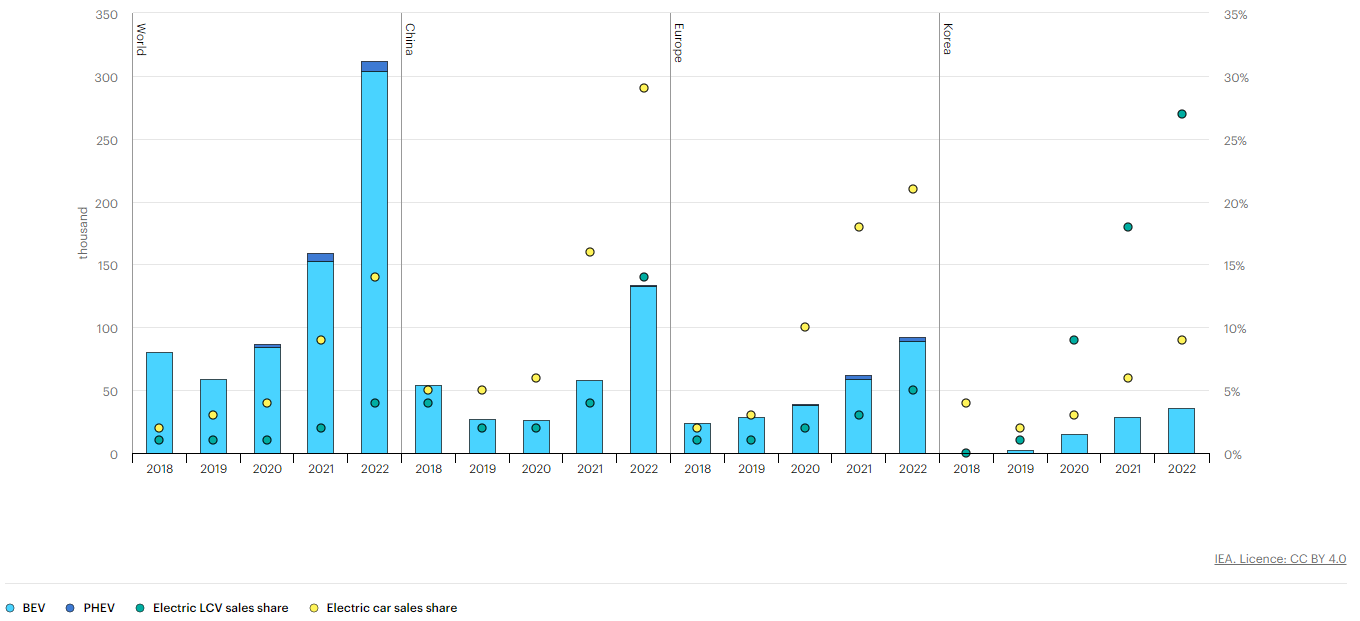

The International Energy Agency (IEA) has noted that global Electric LCV sales almost doubled in 2022 versus 2021 to over 310,000 vehicles. This was achieved even though total LCV vehicles sales (including ICE) were down 10%. Indications are that the LCV market are more attractive as these vehicles tend to be used more than passenger vehicles, plus have the added benefit of centralized charging for a fleet of vehicles, which lowers the hurdle of building out charging infrastructure.

Electric LCV sales and sales shares

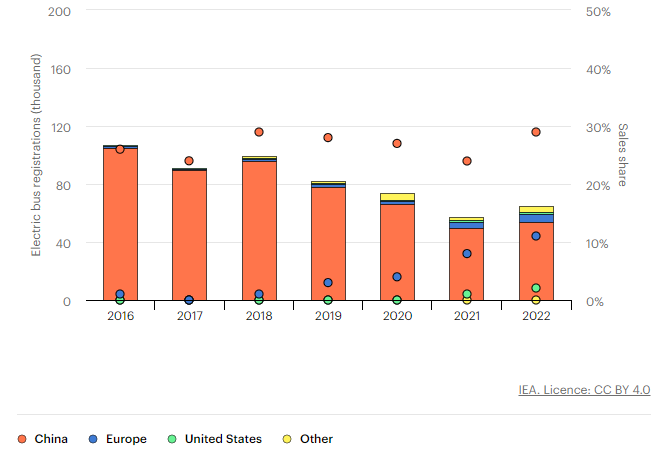

On the Heavy Duty Commercial Vehicle (HDCV) side, China has been the dominant player for a number of years, having implemented electric buses and trucks earlier than the rest of the world. That said, HDCV sales have been growing in Europe and the US in recent years as fleet charging infrastructure has been built out, but also reflecting municipal government and corporate initiatives to reduce emissions.

Electric Bus sales by Region

Electric Truck sales by Region

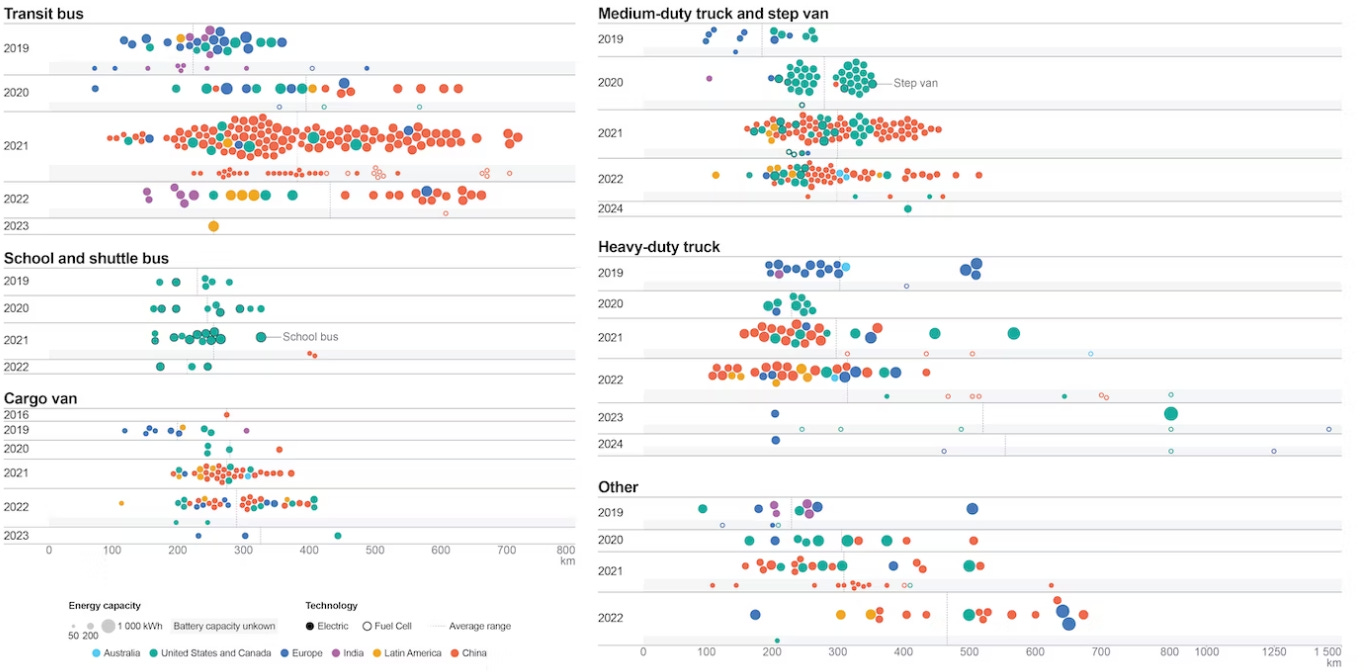

The IEA also notes that the number of models for zero-emission medium and heavy duty trucks continues to grow rapidly, sitting at 840 different models as of 2022. Of these bus and truck model, over 500 were produced by OEMs based in China, over 170 were based in North America, and over 120 were from European OEMs.

The chart below is somewhat messy, but does highlight that the number of product offerings in the electric light and heavy duty commercial vehicle segment continues to grow each year. The driving range (bottom axis), also appears to be gradually improving over time.

Current and announced zero-emission commercial vehicles by models and type

The key takeaway we see as it relates to the Exro / SEA merger is the integrated offering of SEA’s battery technology with Exro’s Coil Driver is serving a growing global market, despite negative sentiment on the EV Passenger Vehicle segment.

SEA Electric Merger Accelerates Tier 1 Status

Most investors are very aware that Exro has been pursuing a number of strategic partnerships to become a Tier 1 supplier to global EV OEMs. We believe there is some negative sentiment on the merger from Exro shareholder perspective in terms of the share dilution associated with the SEA acquisition as well as the equity issuance. However, we see the following as key items that may have facilitated the transaction happening when it did:

Exro’s strategy of becoming a Tier 1 supplier for its Coil Driver is a time consuming process. There is significant testing and verification required before these projects move to the commercial phase. This has been an ongoing area of concern for shareholders.

SEA Electric became a Tier 1 supplier to Mack Trucks in 2023, and is also a Tier 1 supplier to Hino. The integration of Exro’s Coil Driver with SEA Electric’s SEA-Drive propulsion system provides a fully integrated EV end-to-end solution for Tier 1 suppliers once the merger is complete.

more info here: Link

This merger accelerates the deployment of Exro’s Coil Driver into the market relative to what it likely would have been able to achieve alone. With further in-field demonstration from these units, this could accelerate demand for the Coil Driver from other EV OEMs.

Exro/SEA expect to deliver over 1,000 integrated propulsion systems to SEA’s existing client base, with expected 2024 revenue of over C$200M.

The merger allows Exro to begin deploying the Coil Driver at scale in the LDV and HDV markets, while still progressing its strategic initiatives on the Passenger Vehicle side with the likes of Linamar and Wolong.

While the market may have been somewhat surprised by the SEA Electric proposed merger, we see the benefits of exposure to a growing LDV and HDV commercial vehicle market, with a Tier 1 supplier and an integrated propulsion control system offering as being transformative for Exro. The ball is in management’s court to deliver on the new forecasts, however we see improved visibility for revenue and EBITDA growth in the combined entity versus Exro on a standalone basis.