Exro Technologies (EXRO.TO): Commercial Terms with Linamar Announced

Company also enters into $30M financing

Company Website

After market hours on May 15, 2023, Exro announced long-awaited commercial terms with its Coil Driver strategic partner, Linamar. The companies jointly released some tangible sales volumes looking into 2027, which we believe will be well received by investors.

Jointly developing the eAxle

Typically in electric vehicles (EV’s), the motor and inverter are in separate housings. Over the past 2 years, Linamar and Exro have been developing an integrated electric beam axle, which they call the eAxle, which situates both the motor and the Coil Driver in the same housing. The primary benefit is to reduce complexity and maintenance needs. The companies are jointly building a development vehicle, expected to be finished in 4Q23, to be used to market the benefits of the eAxle design to potential customers.

Exro and Linamar expect series (i.e. continuous) production under this agreement to be achieved in 4Q2024. From there, the companies expect sales volumes for the eAxle (with Coil Drivers) to reach 25,000 units in 2027. As a reminder, Exro’s fabrication facility in Calgary, Alberta is on schedule for completion in 3Q2023, with a base capacity of 100,000 units per year assuming only one 8 hour shift per day.

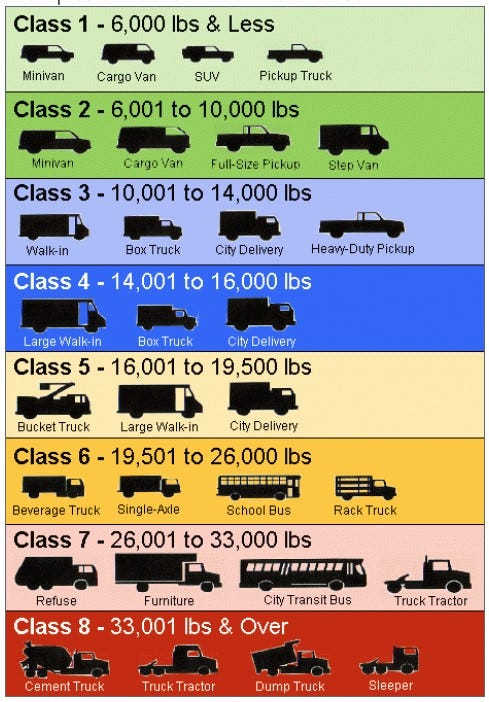

Agreement covers Class 3-6 Vehicles

One of the key elements of the agreement, from our perspective, is Linamar has been granted exclusivity to use the Coil Driver on its Class 3-6 applications utilizing the eAxle technology. From Exro’s standpoint, this still provides the company with the freedom to pursue other arrangements for other classes of vehicles, plus vehicles in Class 3-6 that do not utilize the Linamar/Exro eAxle.

As shown below, Class 3-6 vehicles are largely comprised of vans and larger trucks ranging from 10,000 to 26,000 lbs. Typical applications would be delivery trucks and larger box trucks, and potentially some smaller buses. We see plenty opportunity for Exro to further announce commercial agreements in other classes over coming quarters.

Source

Updating our Revenue Outlook

Our latest revenue outlook only provided a revenue scenario (based on Exro’s announced agreements and interpolating some modest growth) through 2025. Since the new agreement with Linamar only begins late in 2024 and anticipated to grow to 25,000 Coil Driver units annually by 2027, we have extended this analysis a couple more years.

Given the the eAxle design was developed with 800V Coil Driver units provided by Exro, it is our assumption this is the size envisioned with the agreement. We note this would be supported by the size of vehicles in the Class 3-6 categories.

We have left our prior estimates through 2025 unchanged, and have layered in 5,000 800V Coil Driver units in 2025 (was 1,350 previously), growing to 15,000 in 2026 and 25,000 in 2027 (shown in blue in table below).

For the other sizes of Coil Drivers and Cell Drivers in our forecast, we have simply held our prior assumptions from 2025 flat through 2027.

As shown, under this scenario with our pricing assumptions shown, we see potential for Exro’s Revenue to gradually grow to nearly $500M by 2027. Notably, in combination with our sales volumes for other Coil Driver lines, our estimated 35,600 Coil Driver units in 2027 only represents about 36% of the company’s manufacturing capacity. Thus, we still see potential for more commercial agreements to be announced as development and technical hurdles are achieved with other partners (previously announced or forthcoming).

$30M Financing Announced

In conjunction with the Linamar commercial terms, Exro announced it is entered into a bought-deal equity financing, issuing 13.5M common shares at a price of C$2.25/sh (a 13% discount to prior days close) for gross proceeds of C$30.4M. The underwriters have also been granted an over-allotment option of 2.025M shares, which could bring in an additional $4.6M.

The use of proceeds will allow Exro to participate in its share of the Demonstration Vehicle with Linamar. Additionally, Exro will finalize its Printed Circuit Board (PCB) manufacturing capabilities, plus adding a final assembly line in its Calgary fabrication plant. This will set the company up to be able to comfortably deliver its Coil Driver commitments under the agreement with Linamar.

Note: 4Front is not being compensated as part of the Exro’s equity financing.

Checking off another box in 2023

As we have done in prior posts, we include an updated score card summarizing Exro’s key catalysts and achievements in 2023.

Key Takeaways

We view the commercial terms with Linamar as a very positive step forward for Exro. It provides evidence that Linamar was happy enough with the performance of the eAxle to provide as an option to enhance performance for customers. As noted in previous posts, Linamar is a Tier 1 OEM with a large network of existing clients and markets in the EV space. We believe investors have been encouraged by the strategic partnership between Exro and Linamar thus far. However, today’s announcement provides tangible context to what this could mean for Exro in terms of Coil Driver demand.

I was under the impression that the 15000 and 25000 values for the 400/800v CDs included a motor. If that is the case, I don't think the full value can be attributable to EXRO revenue especially in the Linimar deal which is unlikely to have the motor supplied by EXRO. If that isn't the case can you specify where you confirmed those numbers?