Exro Technologies (EXRO.TO) Coil Driver Commercial Production Timing Aligns with Refreshed Board and Management

Open House Highlights

We here at 4Front had the pleasure to be invited to Exro’s open house celebrating the achievement of first commercial production of its Coil Driver units. The event was held last week (Sept. 20, 2023) at Exro’s manufacturing facility in Calgary, Alberta, and was attended by management, employees, capital markets professionals and government representatives.

Achieving commercial production has been a key milestone that we, and investors more generally, have been awaiting. Exro is now on the cusp of transitioning from a pre-Revenue Tech ‘idea’, to a fully fledged, revenue generating entity with growing sales to supply key EV OEM’s globally. Our thesis is unchanged that visible sales growth with a product that enhances EV adoption will draw the attention of institutional investors over coming quarters.

We have discussed Exro’s impressive fabrication facility in the past. But as a reminder, the facility (particularly its clean room where the fabrication actually happens), is one of the only ones in North America. The clean room allows the company to deliver electronic components of high quality and precision with far less risk of defects. The current capacity is 100,000 units per year assuming an 8r/day shift, thus 300,000 units assuming around the clock operation. There is plenty of space for future fabrication lines, as well, meaning far less investment for growth when needed since the building capital has been spent.

Here are a couple of our pics from the event:

Plus, here a link to a video from Exro’s X (Twitter) feed:

Management and Board: Governance in place for transition to growth

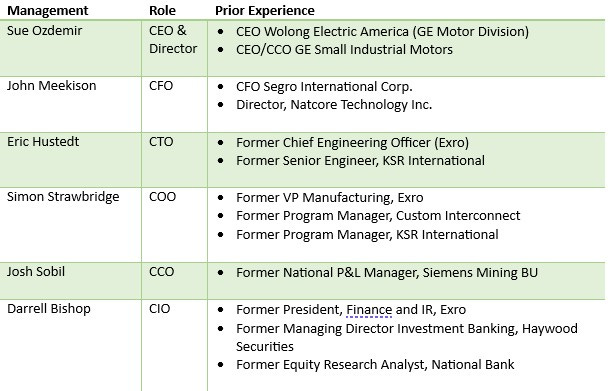

Over the past couple of years, Exro has quietly assembled a team with a broad skill set which we believe will help its transition to growth. Interestingly, the company added 3 new Board members in May at its AGM. In the chart below, we highlight both the evolution of Exro’s management team and Board of Directors over time. Names in orange were with the company at inception, while names in green have been added over the past few years.

We believe it is important for investors to realize that the none of the current Management or Board were with the company when it started. We think this is important for a couple of reasons:

The skills required to found a tech company are not the same as those needed to grow and build a company

New Management and Board members (ideally) bring a wealth of experience, insight and a network that will help companies from a business development perspective, while also helping the company avoid pitfalls encountered in the past with prior companies.

Exro is on the cusp of signing further long-term supply agreements for its Coil Driver and Cell Driver technologies, in regions around the world. While Exro’s Management Team has been expanding in recent years, we believe this is warranted given the sales growth trajectory.

Sue Ozdemir leading the change

Current Exro CEO, Sue Ozdemir, was the first person of the current Management/Board to join the company. She brings significant experience from General Electric, where she was CEO of General Electrics small motors division. Additionally, she was also CEO of Wolong Electric America. She has been the face of the company in most of Exro’s external communications and a key voice in formulating the company’s strategy and vision with investors.

Since Sue joined as CEO, we notice there has been a gradual expansion of key management roles, and concurrently a turnover at the Board level. From our perspective, this is positive as it signals to investors that Sue Ozdemir saw the skill gaps present in the organization and has been actively adding key personnel to take Exro to a global EV and Battery Storage player.

In the next two tables we highlight some of the prior experience for key management and Board members. As seen, the combined team brings significant experience in the following:

International automotive / electrical design and sales

Manufacturing

Engineering

Management

Capital Markets

Electric Vehicles

Public company compliance

Finance

Legal

M&A

Governance Ranks Highly for Investor Risk Management

In our experience in Capital Markets at 4Front, institutional investors tend to place great emphasis on Management and Board quality. With the new positions and skills added at both the Management and Board level, we expect Exro to screen more favorably than it would have in times past. More importantly, we believe the current line-up sets the company up to screen better as revenues grow and more institutional investors can consider Exro for investment.

Checking off another 2023 milestone: Commercial production achieved

As we have been doing all year, we are checking off Exro’s targets we set out at the beginning of the year. One of the biggest goals in 2023 is achieving commercial production at its new fabrication facility, and the company has now cleared that hurdle. Commercial revenue is imminent, starting in 4Q23 and growing into 2024.

I have been with exro since they first listed. As a bit of an electronics buff their theory was sound to me.

On nthe 2023 Score card it says find a financial partner, what does this mean exactly? I haven't heard sue talk about it before.

Also do we uave tentative dates for the larger companies to come out of nda?