New to the EXRO story? Read our introductory post below

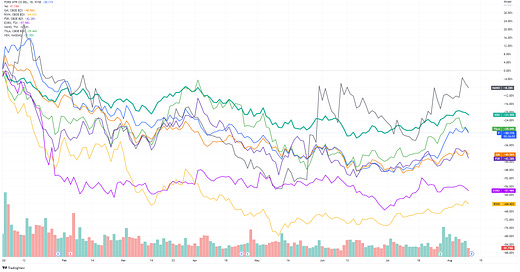

Now lets take a look at how EXRO has been performing in this down market. In the first chart we take a look at YTD performance of EXRO versus US listed automakers for both EV and ICE vehicles with the NASDAQ throwing in for context. It is unsurprising that a pre revenue, small cap company like EXRO has underperformed the automakers who have seen their own headwinds thanks to global supply chain issues.

If we look past the selloff at the beginning of the year its easy to see that EXRO’s stock has found a range and its actually outperforming all of its comps, dropping less than 2% over the last 6 months versus and average of -20%.

Taking a look at the price movement and volume for EXRO over the past 6 months we see that the last two quarterly earnings have surprised to the upside. We anticipate revenue will continue ramp up as the deliver on their purchase agreements, but bigger catalyst for shareholders is evidence on continued customer growth.

We did see a period of weakness in July but that can be attributed to the exercising of roughly 1mm broker warrants ($0.90 strike, July 2022 expiry). Those sales removed all the outstanding warrants and thus should remove any perceived overhang.

From a technical basis its encouraging to see that the vast majority of larger volume days have closed higher which is a bullish signal. The RSI at the bottom of the chart shows us that we are currently oversold, although we could see further weakness in the short term. The movement in the MACD also reinforces the potential buying opportunity in the near term but this opportunity could evaporate quickly with any positive announcement on partnerships or contracts.

EXRO is set to release earnings tomorrow, August 11th. Keep up to date on the latest developments here, https://www.exro.com/news and follow the 4Front team here,

https://twitter.com/4frontJV?s=20&t=YkguGYR-zi-JIebuWoogJg

https://twitter.com/4frontGP?s=20&t=YkguGYR-zi-JIebuWoogJg

https://twitter.com/4frontcf?s=20&t=YkguGYR-zi-JIebuWoogJg

https://twitter.com/4FrontAdvisory?s=20&t=YkguGYR-zi-JIebuWoogJg\