Exro Technologies: (EXRO.TO) 2024 Catalyst Outlook

Active year expected post SEA Electric Merger

2024 Revenue Growth to Drive 2025 EBITDA

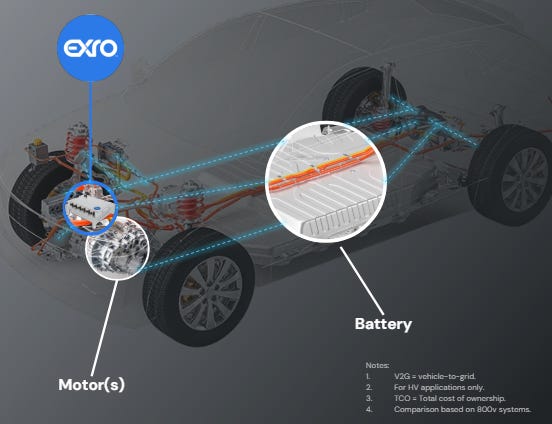

With the closing of its merger with SEA Electric in April 2024, Exro is poised to finally transition to deliver revenue growth in 2024, supported by Coil Driver scale production as it is integrated with SEA Electric’s existing offerings and clients. Ongoing development with partners such as Linamar and Wolong will add another layer of Coil Driver revenue towards the end of 2024. Exro management has indicated it expects to be EBITDA positive in 2025 as it executes on these initiatives.

The company’s Cell Driver (Battery Storage) and Vehicle Systems divisions will further provide revenue visibility.

2024 Catalyst Outlook

Considering the SEA Electric merger is now complete, we thought it would be worthwhile to revisit our catalyst outlook for Exro over the remainder of the year. Similar to our 2023 outlook, we have identified several catalysts for investors to watch for over coming months. The key of these are shown below. We will note when these hurdles are cleared and expand the list, if needed, as the year progresses.

Coil Driver Commercialization Front and Center

Exro is in ongoing development with a number of development partners. The two we have highlighted are Linamar and Wolong, though there are several others. Exro’s manufacturing facility in Calgary, Alberta is complete and operating, just not at series scale. The company is largely producing one-off batches of Coil Drivers of various voltages for ongoing testing with partners. We expect commercial orders for these two companies by the end of the year, which will see production ramp quickly.

Frankly, we see this as the most crucial event for Exro. From our conversations with investors, many are waiting for visibility of commercial order growth prior to establishing (or increasing) investments in the company.

NDA Partner Unveiling

We believe an ongoing source of frustration for both investors and management has been lack of clarity regarding potential partners with whom Exro is in talks. Management obviously would prefer to be more open, though understandably there is hesitation on the partner side. We think it is important for investors to recognize potential partners typically prefer to remain under NDA as disclosing its discussions and activities with Exro could negatively impact its relationships with existing suppliers. That said, we do expect some clarity on this front in 2024 as these partnerships become nearer to commercial agreements. Once the NDA partners are revealed, we see potential for the market to take greater notice on the size and quality of Exro’s counterparties.

Some key announced and yet to be announced partnerships are shown below (per company’s corporate presentation).

Cell Driver: Potential Next Steps

The primary catalyst we see for the Cell Driver technology is final UL certification. This has admittedly taken longer than we originally anticipated but management indicates is expected to be approved in the next few months. This is the critical step necessary before commercial production of these battery storage systems can commence.

Does a Cell Driver Spin-out Make Sense? One thing we have postulated might make sense at some point is a spin-out of the Cell Driver technology. We think this may make even more sense in light of the merger with SEA Electric. The vast majority of Exro’s near-term revenue outlook is linked with Coil Driver sales. Arguably, the Cell Driver tech is somewhat dwarfed within the company as it stands. While we are not aware management is actively evaluating this as an option, it may make sense to carve out the Cell Driver into standalone business. This could help unlock the value associated with this business line which we believe is undervalued at Exro’s current market cap.

NASDAQ Uplist

Exro has been targeting a NASDAQ listing for a couple of years now. While it likely makes sense as the company achieves revenue growth in 2024, at its current share price this is not likely an option in the near-term. However, we expect management to evaluate this once necessary listing requirements are met, which could open up access to a broader US investor base.

EV Sentiment is Low, Execution is Key

The market sentiment towards the EV space has been weakening over the past year. Companies such as Tesla have massively cut prices to kick-start deteriorating demand, while other passenger car manufacturers are rolling back on commitments for sales to be entirely EV by specified dates. As we have noted in prior posts, we believe these forces are weighing on Exro’s share price, with the read-through being weaker EV demand will therefore result in reduced Coil Driver demand.

In our prior post we noted Exro’s strategy is more focused on fleet vehicles in the near-term, not passenger cars. Thus, for a company essentially starting from zero sales, the initial push will be into this more established market that is actually still growing. Readers can find out more below.

For the rest of 2024, the ball is in management’s court to execute on the strategy and deliver on messaged revenue growth. We see the SEA Electric merger as transformational from the perspective of bolting on existing sales, which should accelerate deployment of Exro’s Coil Driver technology. However, we see it as imperative that organic revenue growth via commercial orders from its Strategic Partners materialize as planned.

This is a great article, thank you. Love that checklist...lots of opportunities! I have been commenting on various boards for over a year that Exro needs to spin out or even sell Cell Driver. This could potentially unlock hundreds of millions, or even billions, of $'s for Exro to achieve several key items on the checklist.