Exro Technologies (EXRO.TO): Delving into the Strategic Partnership with Wolong Electric Group

New to the Exro story? Check out our Intro post here:

EXRO Technologies (EXRO.TO)

EXRO Technologies is a publicly traded Canadian company with a disruptive but complementary technology to electric motors and batteries that, in its simplest terms, aims to make electric vehicles perform better and cost less. The company trades on the Toronto Stock Exchange under the symbol EXRO and over the counter in the United States with the ticker…

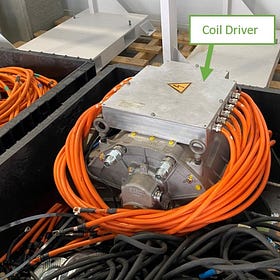

On April 17, 2023 Exro announced it has added another strategic partner for its Coil Driver technology in Wolong Electric Group. This secures a second key partner for Exro, in addition to the previously announced strategic partnership with Linamar.

The partnership brings together Exro’s Coil Driver inverter technology and Wolong’s EV motor design, manufacturing and supply expertise. Initially, the combined powertrain solution will in EV applications for commercial and off-highway vehicles in the Americas, though there exists future possibility of licensing the Exro Coil Driver to Wolong for use in Asia. The structure of the Wolong partnership is comprised of:

Phase 1: Wolong will deliver electric motors to Exro, who will in turn test the motors and develop the motor-inverter system for light, medium, heavy duty and off-highway applications. The dynamometer testing is anticipated to be complete by year-end 2023.

Phase 2: Once testing is complete, the companies will jointly prepare volume targets for the Coil Driver, as well as pricing and compensation models and marketing plans.

Positive news, but tough to quantify

Initial reaction to this new seemed to be well received, as share prices rallied nearly 8% on the day of the news. However, the share prices has subsequently sold off back to pre-announcement levels. From our perspective, we believe investors were positive on the announcement on a number of fronts:

Wolong is one of the top global EV motor manufacturers. This further diversifies Exro’s market potential in the context of already having Linamar as a partner. This is particularly true if the Wolong partnership ends up opening the door for Asian expansion for Exro.

Exro’s CEO, Sue Ozdemir, was previously employed at Wolong, which we believe bodes well for the relationship between the two companies.

On the other hand, investors were potentially a bit disappointed with lack of clarity on timing of orders and magnitude of revenue from the Wolong agreement. While we acknowledge waiting for clarity on this until Phase 2 is complete is a bit disappointing, it is worth focusing on the size of Wolong and potential to have a material order coming on the heels of successful verification of the Coil Driver.

Wolong Electric Group: A leader in electric motors

Wolong Electric Group Co. Ltd is a Chinese company headquartered in the city of Chengdu, Sichuan province. The company specializes in the production and sale of electric motors and related products. Wolong Electric Group was founded in 1984 and has since grown to become one of the largest manufacturers of electric motors in China, with a presence in over 100 countries.

Source: https://www.wolong-electric.com/about/create.html

According to its website, the company has a market share of over 20% in the domestic market and over 10% in the global market for small and medium-sized motors. In addition to electric motors, Wolong Electric Group also provides a range of related products, including generators, inverters, and motor control systems. While the name Wolong may be unfamiliar to many, the company owns an operates under a number of better know brands:

Source: https://www.wolong-electric.com/about/brand.html

Wolong Electric Group's key customers include companies in the home appliance, automotive, and industrial equipment industries. In addition to electric vehicles, the company supplies motors for a variety of applications, including air conditioners, washing machines, refrigerators, and industrial robots.

Wolong Electric Group has also been expanding its product offerings to include products related to new energy and smart grid technology, such as wind turbines and energy storage systems. While not part of the current partnership, this could be another avenue for Exro to pursue with its Cell Driver technology for battery control.

Putting it all together, while investors can’t really adjust their forecasts on the Wolong news, we see the agreement as supportive of Exro’s ongoing strategy:

Wolong is a large and proven player in the global electric motor market

It further diversifies the Coil Driver partnerships (with Linamar and Undisclosed Party), potentially into new markets

Exro management has a strong relationship with Wolong and is motivated to move this agreement forward.

Updating Exro’s Scorecard

Reflecting the Wolong partnership, we are updating our 2023 scorecard to highlight this is the second Coil Driver partnership announced this year, in addition to the undisclosed party announced in February. We have also added completion of Wolong’s Phase 1 deliverables as a key milestone for 2023.

As we have stated in prior notes, the key milestone for investors in 2023 will be commercial production from the manufacturing facility in Calgary, Alberta. This will allow the company to move to revenue-generation and execute on targeted growth plans.

What we see in the recent share price movements

This first chart shows the upward trend that EXRO was in since the middle of last year. As you can see there was a nice trading channel that has since broken down. With EXRO now trading below this level the lower bound of the channel should act as a resistance level as seen back at the beginning of April when the stock tried and failed to break through. As we continue to trade sideways the relevance of this resistance level will dissipate.

What we see now is a more horizontal trading range to continue in the absence of any material announcements. The $2.15 level has flipped from being resistance (highlighted in the red bubble) to a support level that was tested and held back in March. I would anticipate this to be the bottom of a near term trading channel. On the upside $3.00 would be the resistance level that’s the most meaningful and could be a level that shorts are looking at to layer on additional positions. A sustained break through here could trigger some short covering which would help propel the stock to some solid 1-year highs.

The bottom part of this chart shows the PVT which is essentially a measure of money flows. Its most useful when you see it diverging from share price as it can indicate a momentum shift. In the case of EXRO the continued steady positive money flows are comforting but not material. The momentum indicators are all showing a pullback from lofty levels seen earlier in the year but are barely in negative territory, which we take as a confirmation of the sideways trend.