Canadian Critical Minerals Ecosystem

Post 1: Exploring Canada’s Potential Global Role

This is our first post on what will be a series exploring the entire Canadian critical minerals ecosystem, where we will cover upstream production, midstream processing and finally downstream end use. As global governments push mandates for their respective countries to transition to Electric Vehicles (EVs) and other energy transition technologies, we seek to understand Canada’s ability to be a domestic and global supplier for these critical minerals.

The Government of Canada has recently announced its Critical Minerals Strategy (Critical Minerals in Canada), which identifies 31 Critical Minerals that can be produced here in Canada. Of these 31 minerals, 6 have been identified as high priority due to their contribution to the EV and Renewable Energy markets. Those minerals are Lithium, Graphite, Nickel, Cobalt, Copper and Rare Earths.

Source: The Canadian Critical Minerals Strategy

Resource Rich, but can it be monetized?

As you can see by the map below, Canada has an abundance of these materials spread out across our provinces and territories and while extraction of these minerals is key to expanding Canada’s reach into the EV market a focus on the entire supply chain from refining, processing and components manufacturing is needed to capture the true value of our natural resources. A report by Clean Energy Canada (Full Report) has estimated that Canada has the potential to build a domestic EV battery supply chain that could support up to 250,000 jobs by 2030 and add $48 billion to the Canadian economy annually.

Source: The Canadian Critical Minerals Strategy

Ultimately, Canada’s ability to grow supply of these materials to meet domestic and foreign demand is still contingent on the typical factors for any resource extraction, including those below (non-exhaustive):

Commodity prices

Transportation

Resource grade

Capital and operating costs

Technology

Human capital

Fiscal regime (royalties, taxes, etc.)

Funding

While the intentions by the government to stimulate the transition from traditional hydrocarbon-based energy supplies may have merit, the economics of proposed projects ultimately need to be high enough to attract private capital. We see Canadians, in general, as having little appetite for the government investing billions into opportunities with low to negative returns.

Initial Funding Ramping Up

Along with the critical strategy the federal government has budget commitments from 2021 and 2022 that cover different aspects of the critical minerals value chain, from exploration to processing and refining, to more advanced products.

They include:

$79.2M for public geoscience and exploration

30% Critical Mineral Exploration Tax Credit for targeted critical minerals

$47.7M for targeted upstream critical mineral R&D

$144.4M for critical mineral research and development, and the deployment of technologies and materials to support critical mineral development for upstream and midstream segments.

The 2021 and 2022 budget includes funding for project development including:

$1.5Bn for the Strategic Innovation Fund (SIF) to support critical minerals projects with prioritization given to advanced manufacturing, processing, and recycling applications

$40M to support northern regulatory processing in reviewing and permitting critical minerals projects.

$21.5M to the Critical Minerals Centre of Excellence (CMCE)

We have already seen the SIF begin to deploy capital into this ecosystem, recently announcing a $27M investment into E3 Lithium (ETL:TSX). We would expect similar announcements to be made throughout the year across the entire value chain.

Source: The Canadian Critical Minerals Strategy

Canada will have some competition from our neighbours to the south who announced significant investment into decarbonizing their economy through the Inflation Reduction Act of 2022. Some of the funding aimed at energy security and domestic manufacturing includes:

Production tax credits to accelerate U.S. manufacturing of solar panels, wind turbines, batteries, and critical minerals processing, estimated at $30 Bn.

$10Bn investment tax credit to build clean technology manufacturing facilities, like facilities that make electric vehicles, wind turbines and solar panels.

$500M in the Defense Production Act for heat pumps and critical minerals processing

$2Bn in grants to retool existing auto manufacturing facilities to manufacture clean vehicles, ensuring that auto manufacturing jobs stay in the communities that depend on them.

Up to $20Bn in loans to build new clean vehicle manufacturing facilities across the country.

$2Bn for National Labs to accelerate breakthrough energy research.

Critical Materials Demand is immense...can it even be met?

While government support is critical to building out a brand-new ecosystem the industry will also require capital investment from private entities. For that to happen the demand side of the equation has to be compelling. When we take a look at the data provided by the IEA, we can see that the demand growth in these metals is very robust even when taking a conservative view on EV adoption.

The Battery Metals Associate of Canada had this to say about the IEA’s growth estimates for battery demand in their roadmap report (Roadmap for Canada's Battery Value Chain).

“To meet the goals in the IEA’s sustainable development scenario, the world needs to go from 6.5 million vehicle sales in 2021 to 40 million vehicle sales in 8 years. And The International Energy Association (IEA)’s SDS scenario is not even net-zero in 2050 (it reaches net-zero around 2070), so the pace must increase rapidly.”

The expected demand growth for metals that comprise EV’s suggests that without significant increases in production, pricing pressure will continue. One variable that we will discuss in a future post is trying to predict which battery chemistry is going to win the day. Currently, Lithium Ion batteries with a Nickel/Cobalt cathode are the industry standard but Lithium Iron Phosphate (LFP) batteries are growing both in production and adoption. In China, 50% of EV’s are now built with these LFP batteries.

Our View on Canada’s Role in the global critical mineral supply chain

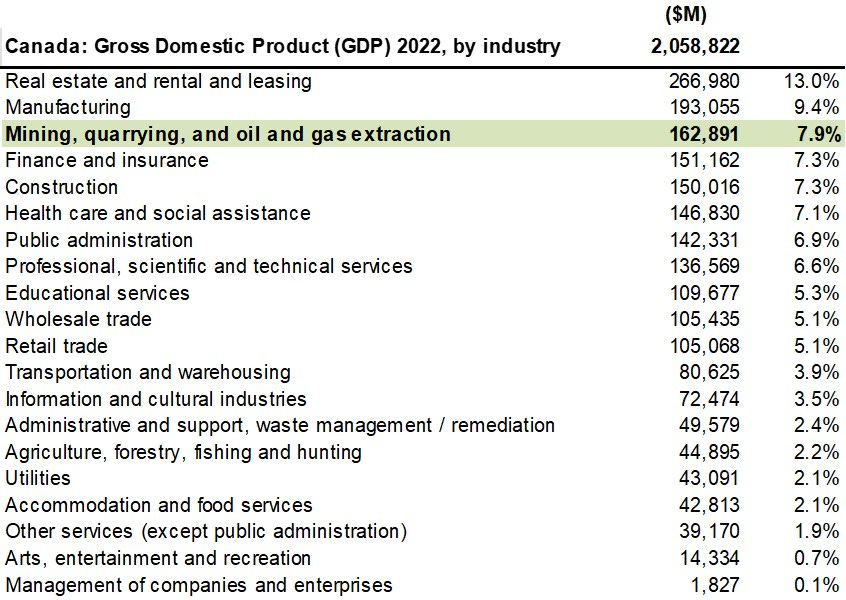

On the surface, Canada’s abundance of critical minerals should be met with optimism. Resource extraction industries (oil, gas, mining) have been a leader in our domestic GDP for decades. As of July 2022, Mining and Oil and Gas Extraction represented nearly 8% of Canada’s GDP.

Source: Statista

We have the technical expertise for future mining development of critical minerals. That said, evolving to be a global leader is not a slam dunk. As we know all too well from oil and gas and mining, uneconomic resource in the ground tends to stay in the ground. Our current thoughts are as follows:

Canada is in a good position to provide a domestic and potentially global supply of responsibly developed resource relative to other jurisdictions.

Not all proposed projects will be developed, with a near-term focus on higher-grade, higher-return projects being able to attract the necessary capital.

The transition to Electric Vehicles and Battery storage will likely be slower than expected. Forcing the transition without a thoughtful build-out of infrastructure, or without a rigorous review of ensuring a reliable source of energy supply for Canadians has the potential to drive up energy costs for consumers and erode quality of life.

The need for hydrocarbon-based energy, particularly cleaner burning natural gas, will remain longer than government net zero targets. Canada also has a role to displace higher intensity CO2 emission energy sources via LNG.

More to come…stay tuned

Over coming months in this series, we will dig into the following:

Supply / Demand forces for the 6 Critical Minerals in Canada

Battery technology overview

Key players in each link of the value chain (upstream, midstream processing, and finished products)